Have you ever heard the saying, "An ounce of prevention is worth a pound of cure"? That philosophy couldn't be more accurate for property owners in Naples.

While hurricanes and floods grab headlines, the hidden financial risks of power surges can quietly wreak havoc on your properties. It's not just about replacing a fried circuit or blown appliances; it's about protecting your investment, minimizing tenant complaints, and staying ahead in a climate-sensitive housing market.

Surge protection is no longer an afterthought. It's a requirement for safeguarding your property.

Naples' Rising Risks

Natural disasters have increased across Southwest Florida. Hurricanes Ian and Helene are stark reminders of the region's vulnerability. These storms don't just flood properties; they also wreak havoc on electrical grids, causing damaging surges that short out appliances, HVAC systems, and more.

Even a brief surge can leave tenants grappling with broken equipment or wiped-out personal electronics. These moments aren't just inconvenient; they drive up electrical problems and repair costs, reduce tenant satisfaction, and can even lead to extended vacancies.

With the frequency of extreme weather events rising, surge protection is no longer just a tech upgrade; it's a financial safeguard for your home.

The Fallout from Recent Hurricanes

When Hurricane Ian blew through Southwest Florida, the damage wasn't just visible roof collapse or flooded streets. Power surges silently caused widespread destruction to essential property systems.

Marco Island, Cape Coral, and Naples homeowners learned the hard way that unprotected properties were significantly more expensive to repair and replenish.

Worse, property owners navigating insurance claims encountered challenges if preventative measures like surge protection weren't in place. Insurers scrutinize these cases. Without proactive solutions, claims for damaged systems or appliances may be delayed, denied, or underpaid.

This problem can be especially relevant when evaluating flood insurance policies or filing claims, as insurers consider the preventative measures for affected properties.

Insurance and Surge Protection in Naples

Florida's insurance industry isn't cutting property owners any slack. With rising claims from natural disasters, premiums are climbing while policies grow more restrictive.

Carriers now expect investments in risk mitigation, including surge protection, for properties in flood zones or areas prone to extreme weather.

Why? It signals responsibility to insurers. Installing surge protection reduces the likelihood of expensive claims over electrical damage, which means a lower risk for insurers.

This simple investment could help you avoid higher premiums or policy exclusions while giving you a firmer footing when you file a claim.

But surge protection also protects you against more than insurer scrutiny. Repairs for electrical systems or appliances fried by surges can cost thousands. Adding protection saves you from these repeat expenses while delivering tenant peace of mind.

The Role of Surge Protection for Rental Properties

If you manage rental properties, you know that tenant satisfaction directly impacts tenant retention. Broken appliances, malfunctioning HVAC systems, or longer repair times after storms can drive tenants toward competitors.

Surge protection enhances your reputation as a landlord who prioritizes safety. When tenants feel their electronics, comfort, and appliances are secure, they're more likely to renew leases.

That's not to mention the growing number of renters who ask about storm protection when choosing a home. Showing them your fully equipped property can help you attract better tenants.

A thorough examination of vulnerable systems gives you an edge in offering this added layer of confidence.

The Real Estate Edge

If you're investing in real estate, you know it's no longer just about location. Today's prospective buyers and tenants care about risk management. They want to know how properties will withstand floods, hurricanes, and unexpected power issues.

Naples properties with surge protection stand out in this competitive market.

It helps landlords justify increased rents when tenants see their home as a secure, storm-ready haven.

For investors, surge protection eliminates a sticking point in many negotiations or buyer concerns. It signals that your property has been well-planned, easing the buyer's anxiety about long-term maintenance costs.

With real estate agents often emphasizing climate resilience as a key selling point, surge protection positions your property as a cut above the rest.

A Necessary Upgrade for Southwest Florida

Returning to Florida law and compliance, surge protection isn't yet a legal requirement. However, evolving local legislation clarifies that properties must meet higher quality and safety thresholds to adapt to climate risks.

If left vulnerable to foreseeable damages, properties in flood zones face more inspections and new penalties. Reducing flood risk while incorporating surge protection into your upgrades strengthens your overall compliance readiness.

Surge protection fits seamlessly within broader trends to future-proof homes in high-risk areas. Getting ahead of these changes puts you in a better position than property owners scrambling to meet future mandates.

Breaking Down the Costs

Surge protection's affordability might surprise you. A system covering an entire home usually costs between $500 and $1,000 to install. When stacked against potential losses, this is a small price to pay.

Repairs to significant appliances alone can far exceed that amount, not to mention the compounding costs of HVAC replacements, rewiring, and repairing tenant-owned electronics.

And it's not just the direct costs. Downtime between repairing storm-related issues can cost landlords months of lost rent.

A one-time investment in whole-home surge protection delivers years of operational reliability.

Boosting Property Value

Surge protection is a smart move for homeowners preparing to sell their homes. Safety features like floodproofing and electrical protection improve homes' marketability in today's real estate climate.

The added value cuts through buyer anxieties and encourages quicker offers, saving you the hassle of prolonged listing periods.

Investors in Southwest Florida have already begun upgrading properties to meet buyer expectations. It's no longer just about luxury amenities; practical protections matter more than the latest appliances when storms hit.

Steps to Take Now

Start by assessing your existing property. What electrical systems could be exposed to storm-related surges?

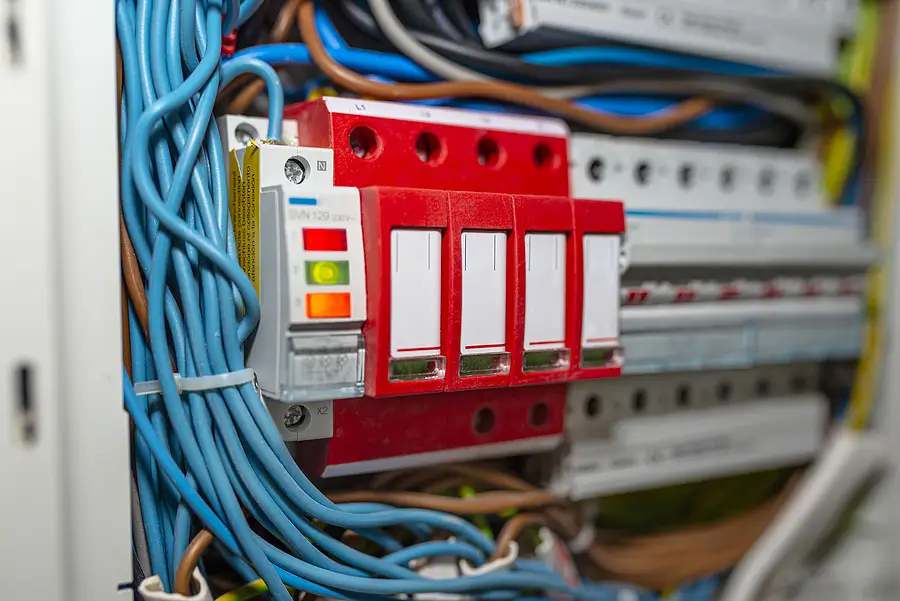

Installing whole-home surge protection is a foundational first step, but you can layer on point-of-use surge protectors for added fail-safes on high-value appliances.

Partnering with an electrician specializing in surge protection will give you insight into your property's vulnerabilities. They'll help you craft solutions designed for longevity and resilience.

Prepare, Don't Repair

Naples property ownership is about maximizing value while weathering the undeniable risks Florida's climate brings. Surge protection isn't just a feature to brag about during a sales pitch or a point to appease an insurance agent.

It's the foundation of keeping your investments intact, and Powerhouse Home Services is here to help you safeguard what matters most.

Invest in reliability, resilience, and readiness because the next hurricane, heatwave, or flood isn't a matter of if. It's a matter of when.

Other Resources:

Protect Your Property in Naples with Reliable Gas Line Repair Services

How Programmable Thermostats Enhance Energy Efficiency for Naples Property Owners